Market Headlines June 26, 2025

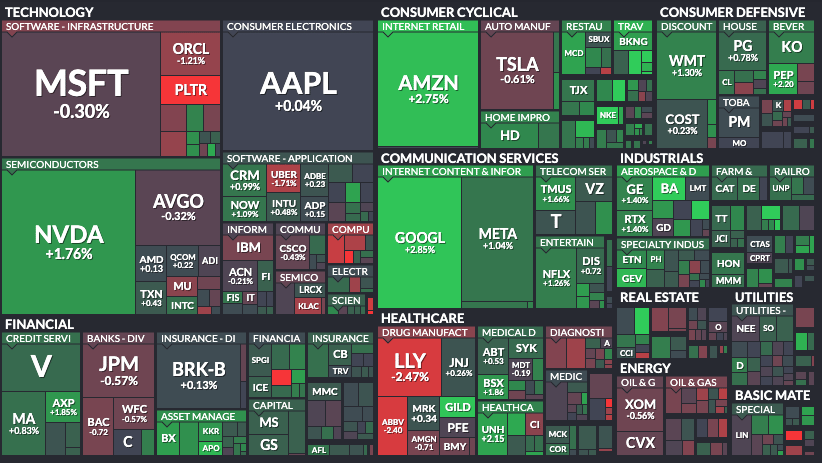

Markets Hit Record Highs

S&P 500, Nasdaq, Dow all reached new record closes despite ongoing trade and inflation concerns.Key Movers & Pops (Stocktwits Community)

Community-driven action and trending stocks.- Cyngn (CYN): +20% Friday, +300% week on Nvidia robotics event.

- QuantumScape (QS): -13% after technical update news.

- Rocket Lab (RKLB): +17% on new ESA contract.

- BigBear AI (BBAI): +45% as biometric contracts land.

- Nike (NKE): +18% one-day gain after Q4 beat & upgrades.

Full brief: Stocktwits The Daily Rip

Full brief: Stocktwits The Daily Rip

Macro, Credit & Rates

Macro Overview

Sentiment, credit, and global currents (from Daily Shot Brief).

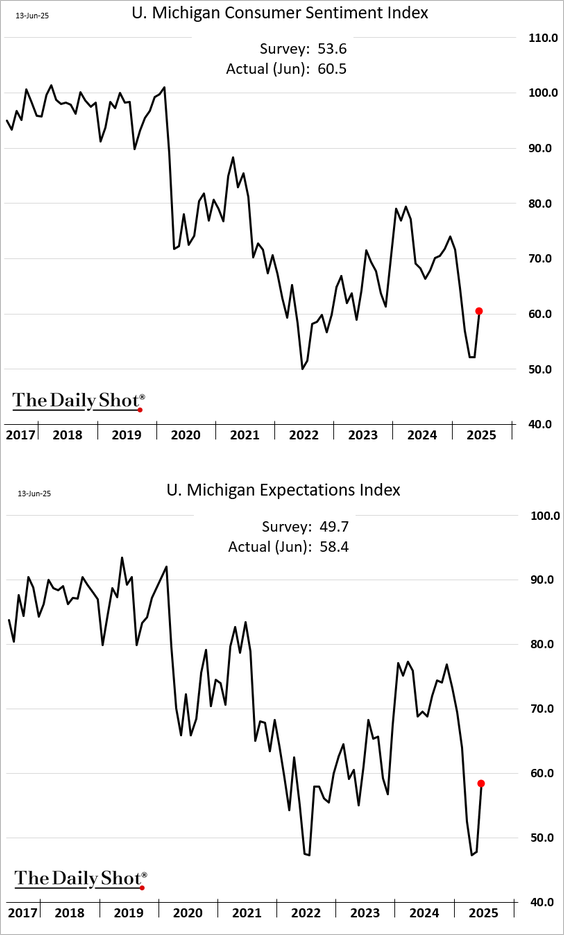

- UMich Consumer Sentiment index jumped to 60.5 (from 52.2), well above consensus.

- U.S. consumer optimism remains high despite PCE inflation ticking up in May (core PCE 2.7% y/y).

- Deutsche Bank and FOMC expect two rate cuts this year—even as inflation projections rise.

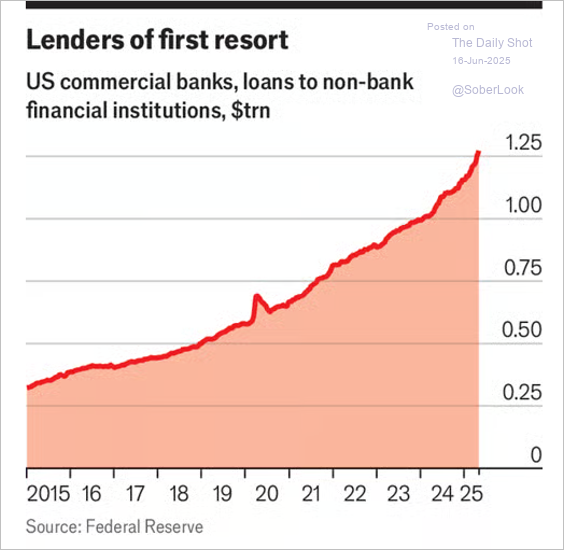

- Bank lending to non-bank financials exceeds $1.25T, underscoring growing financial system risk.

- Canadian loonie and Norwegian krone are strengthening on energy and trade data.

Inflation, Policy, & Fed Watch

- FOMC projects two cuts in 2025—timing uncertain.

- Trump’s new tariffs loom over U.S. tech.

- Brent sees 19th-largest weekly climb since 1988, but trades below $75/bbl.

Emerging Trends & Opportunities

Opportunity Watchlist

Stocks and sectors getting traction:- AI, Robotics & Tech: Cyngn/Nvidia, BigBear AI, Microsoft AI chip delays.

- EV, Space & Quantum: Rocket Lab, QuantumScape battery breakthroughs.

- Retail: Nike, American Outdoor.

- Healthcare: Gilead Supreme Court win.

- Bitcoin/Fintech: Bitcoin Depot +300% YTD, ATM revenue surges.

Key trend: Market broadening beyond mega-cap tech. Small/mid-cap and “new economy” sectors gaining ground.

Risks & Watchpoints

- Rate & Policy Uncertainty: "Lower for longer" may flip quickly.

- Tariffs: Tech, auto, energy vulnerable.

- Consumer: Confidence high, but margins shrinking.

- Shadow Banking: Non-bank credit surging.

Community & Social Buzz

Social Trends

Market sentiment and community favorites on Stocktwits.- Cyngn (CYN): Most upvoted.

- Nike (NKE): Big day.

- S&P 500 record highs despite headwinds

Interactive: Latest Hot Stocks

Emerging Today:

Record stock market closes! Cyngn, Nike, Rocket Lab, and BigBear AI are among retail favorites...

Record stock market closes! Cyngn, Nike, Rocket Lab, and BigBear AI are among retail favorites...